BUSINESS CARDS AND LINES OF CREDIT

SMB revenue data to fuel growth and reduce risk

Enigma provides the dynamic intelligence you need about a small business’s finances, built directly from a panel covering more than 40% of all US credit and debit card transactions. Card issuers and line of credit providers use Enigma’s revenue and firmographics data to grow their business, manage credit lines, and reduce risk.

Our Customers

Increase approval rates, minimize losses

Using Enigma’s fresh revenue data, the typical business credit card issuer can increase approval rates by high single digits, without requiring any permissioned data.

Several of the largest U.S. card issuers use Enigma data to approve qualified small business applicants that otherwise would have been rejected due to incomplete or dated information.

Identify, segment, and engage your best prospects and customers

Enigma gives Sales and Marketing teams access to the same rich data used by underwriters. Target and engage your ideal customers, improving campaign ROI. Enigma data enables you to confidently prequalify more customers for larger amounts, resulting in higher conversion rates.

Gain full visibility into your portfolio health

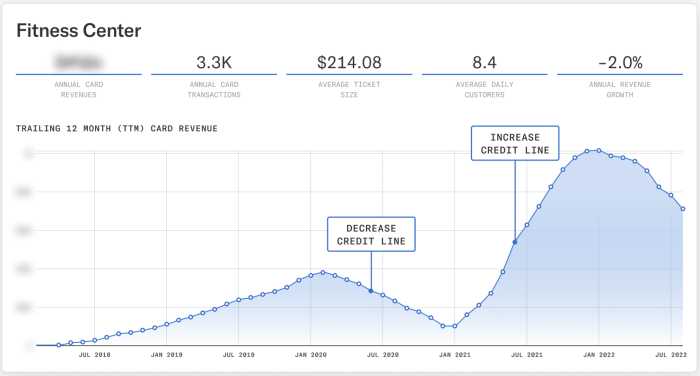

With revenue data that updates every month, you’re able to respond to portfolio changes as fast as the markets demand.

- Drive revenue by increasing credit lines automatically for customers that are growing their revenues and entering seasonal high trends.

- Identify early warning signals and act to reduce losses for businesses whose revenues are declining or becoming less stable.

Seamless customer onboarding and fraud prevention

Reduce manual onboarding processes with instant business verification and fraud screening. Enigma can lift match rates by over 30% for corporate registrations and other KYB criteria, compared to traditional providers.

Why Enigma?

Enigma provides a comprehensive profile for every U.S. small and medium business. Each profile includes key information about business health and identity. For businesses that accept card payments, Enigma provides accurate revenue and growth data, built directly from the largest panel of U.S. credit card transactions in the market.

Explore our full catalog of data attributes here.

REAL REVENUES

- Monthly business revenues, updating each month

- Understand which businesses are growing or declining month-over-month

- Built from 750 million+ cards, covering 40%+ of US card transactions

COVERAGE

- Strong coverage of the long tail of businesses

- Real revenue data for over 10M merchants

- Covers 80%+ of businesses in consumer-facing industries

ACCESS

- No business owner authentication required

- Enables use cases where open-banking data falls short

- Your choice of access: API, batch processing, file deliveries, business profile search

Interested in learning more?

Get in touch for a customized demo and see the data in action.